New Perspective in Environmental Research Letters together with Josh Burke: https://iopscience.iop.org/article/10.1088/1748-9326/ad796b.

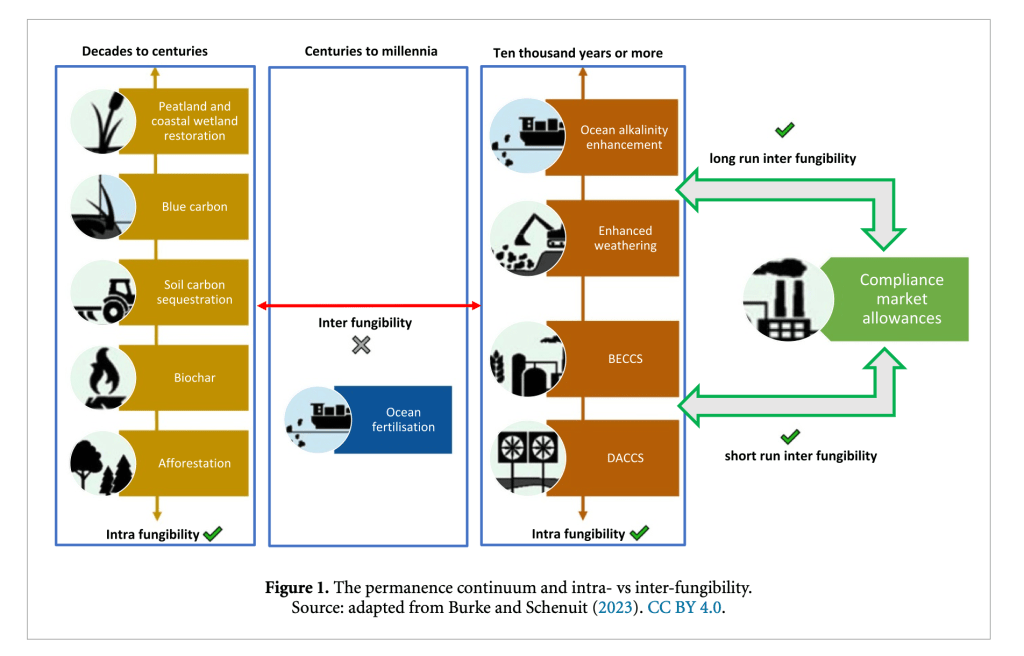

Our key argument: With the growing momentum for carbon dioxide removal (CDR) as a key element of mitigation strategies to achieve net-zero emission targets, its potential integration into cap-and-trade carbon markets is emerging as a key policy issue. A fundamental question in both conceptual and practical policy discussions relates to which CDR methods should be integrated into emissions trading systems (ETS). Based on a mapping and bundling of different measures to address varying permanence and a framework for conditional fungibility, we argue that only methods that are considered “permanent” should qualify for integration. The integration of CDR into compliance markets requires a strategic policy sequencing strategy consisting of three steps: first, the establishment of credible certification through the implementation of robust MRV systems. Second, the introduction of liability measures to address potential releases of removed carbon. And third, defining rules for the integration of CDR certificates into the market so that they can be traded with ETS allowances.